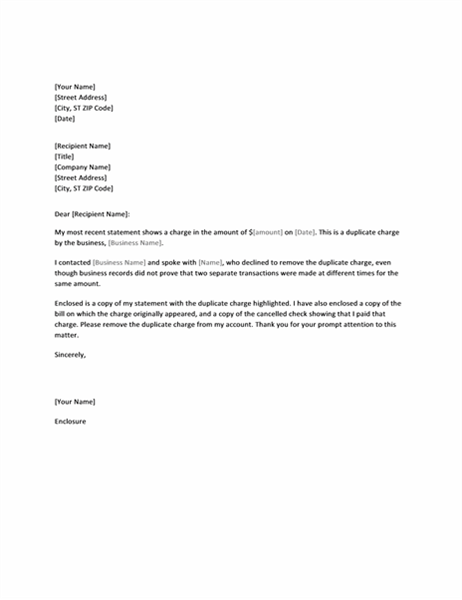

Merchant Chargeback Dispute Letter Sample. Below is a sample of a chargeback letter to a customer. All chargeback disputes begin when a cardholder files a dispute on a transaction with their issuing bank. (On average, a cardholder has between (The reimbursement exists as a temporary credit for the cardholder and can be later transferred back to the merchant should they win the chargeback.

When it comes to chargeback disputes, a lot rests on the merchant rebuttal letter.

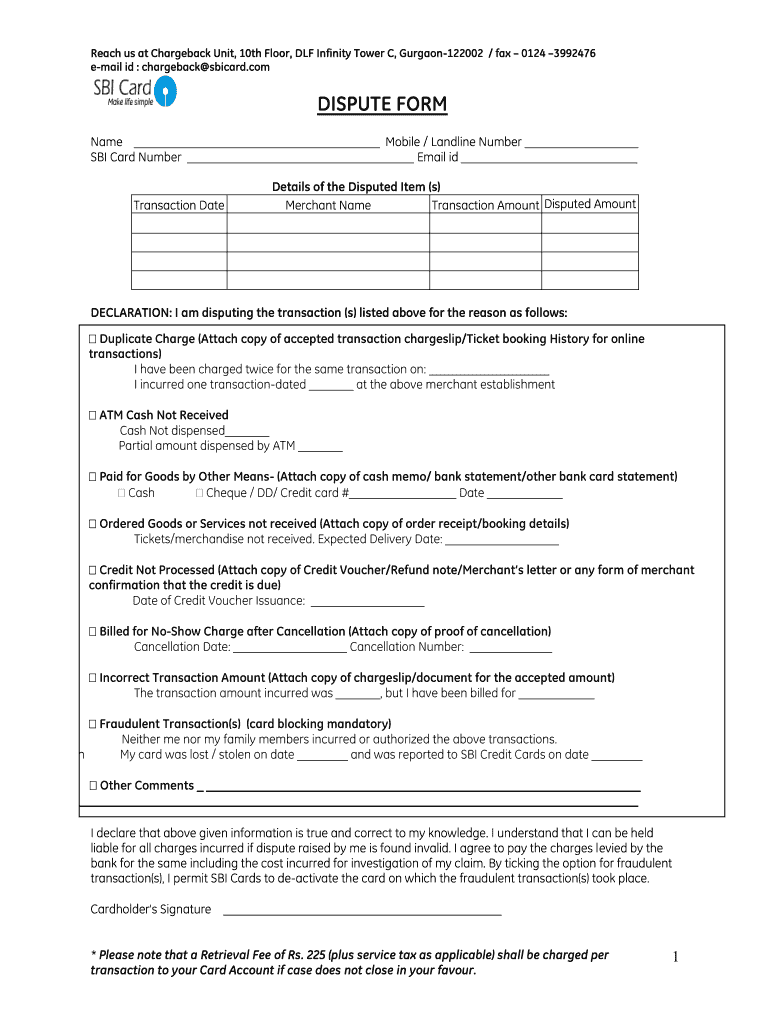

This document covers dispute requirements and best practices for processing transactions that are charged back to the merchant by their acquirer.

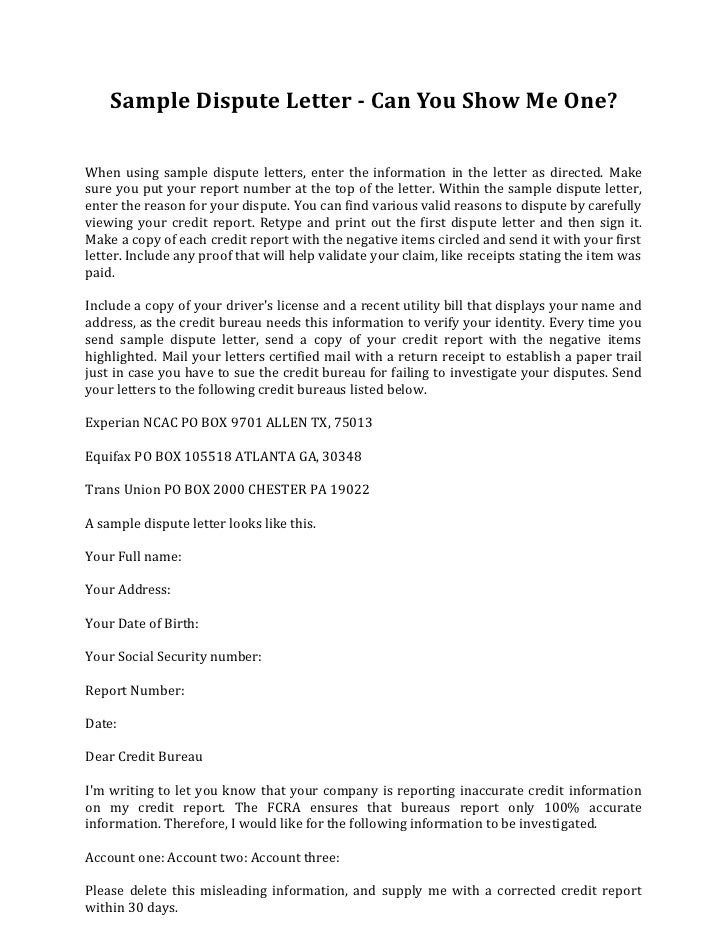

Chargebacks - Merchant Rebuttal Letters - Explanations and Samples to help you fight and win against any chargeback. Below is a sample of a chargeback letter to a customer. Well, of course, you need to provide as much evidence as possible, and you need to organize that evidence in a way that's structured and very easy to follow.