Merchant Cash Advance Agreement Sample. The contract will typically state no fixed date of repayment since the advance is only considered paid once the. Are you about starting a cash advance company?

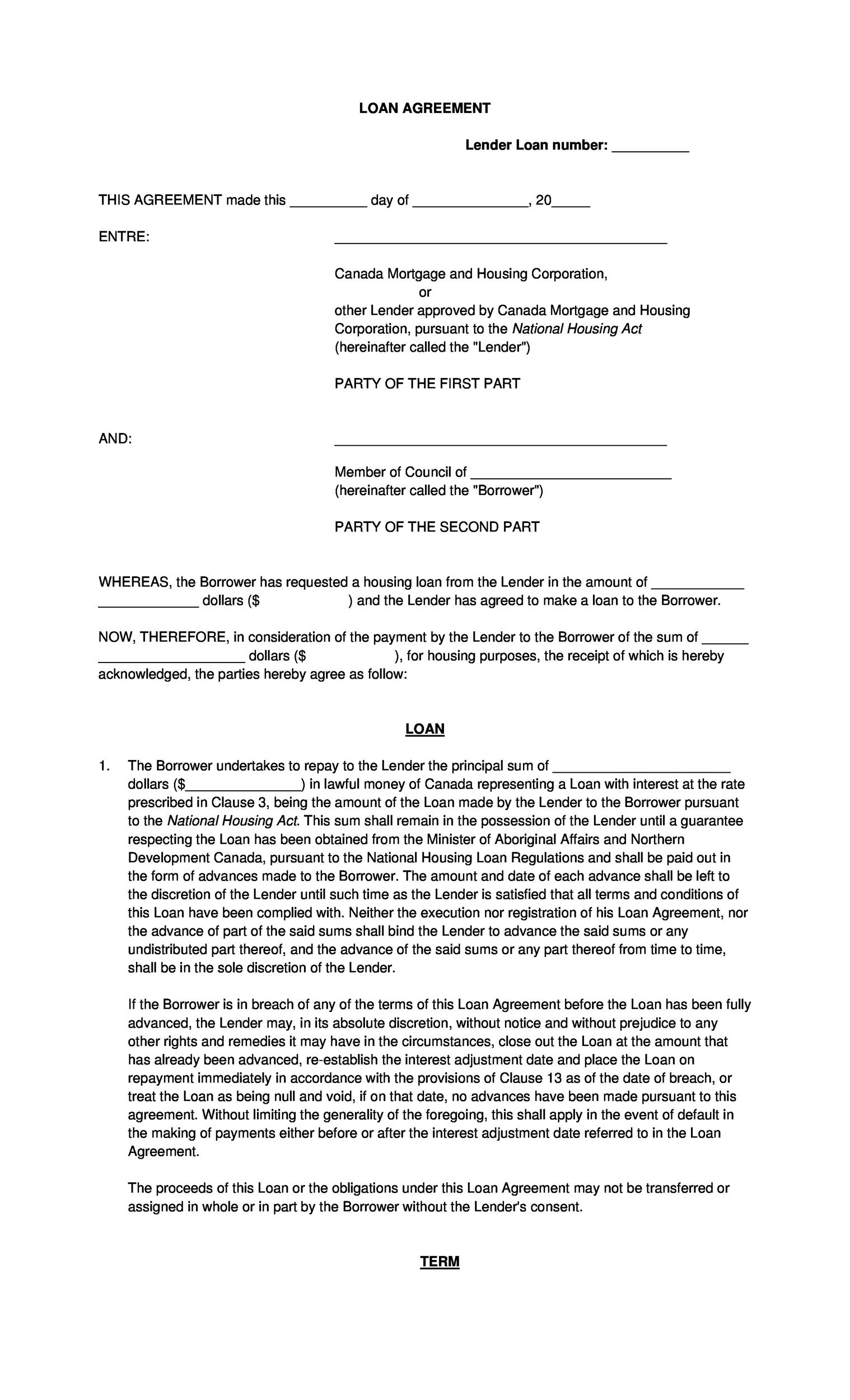

![40+ Free Loan Agreement Templates [Word & PDF] ᐅ TemplateLab](http://templatelab.com/wp-content/uploads/2017/04/loan-agreement-template-27.jpg)

A Merchant Cash Advance is most often used by retail businesses that do not qualify for regular bank loans.

Merchant cash advance providers evaluate risk and weight credit criteria differently than a traditional banker How Does a Merchant Cash Advance Work?

When you go into a merchant cash advance agreement, you'll settle on a fixed percentage that the merchant cash advance company will take from your credit and debit. How do merchant cash advances work? Merchant cash advance providers evaluate risk and weight credit criteria differently than a banker.